FREE Home Buying Webinar - May 18

FREE Home Buying Webinar

Seminar Details

Are you looking to buy a new home but feeling overwhelmed by the process? Look no further! We're excited to invite you to our free Home Buying Webinar, where you'll learn everything you need to know about buying a home, from navigating the housing market to securing a mortgage.

- When:

Thu, May 18, 2023 - Where:

Online Webinar

- The webinar starts from 12:00 PM – 1:00 PM EST

Stay Alert: Protecting Your Financial Information from Phone Scams

Stay Alert: Protecting Your Financial Information from Phone Scams

In the age of evolving scams, safeguarding your financial information is crucial. We want to raise awareness about a phone scam targeting individuals and provide essential tips to keep you safe.

Beware of Spoof Calls:

Fraudulent phone calls from scammers pretending to represent financial institutions are rising. They manipulate caller ID and trick unsuspecting individuals into revealing sensitive information like Secure Access Codes, Card Numbers, or PIN Numbers.

Take Action to Protect Yourself:

Follow these steps to stay safe:

1) Be skeptical: Never share personal or financial information in unsolicited calls. Legitimate institutions won’t ask for such details over the phone.

2) Verify the caller: Hang up if you suspect a fraudulent call. Use the official contact information to confirm their identity independently.

3) Contact your institution: If you encounter a suspicious call, contact them directly using verified contact details. Call us at 954.486.2728 to report incidents and seek guidance.

Spread awareness: Stay informed about phone scams and share knowledge with others to combat fraudulent activities.

We prioritize your financial safety. Stay cautious and vigilant when receiving unsolicited calls requesting sensitive information. Remember, we will never ask for your Secure Access Code, Card Number, or PIN Number over the phone. If you receive a suspicious call, contact us immediately at 954.486.2728. We can protect ourselves and others from phone scams and preserve our financial well-being.

Related Fraud Alerts

Spoof Calls Alert

July 15, 2022

Please beware of spoof calls asking for your Secure Access Code, Card Number or PIN Number.... Read more

Social Security and Your Retirement - May 4

Social Security and Your Retirement

Seminar Details

Social Security will likely be an important part of the road ahead regardless of when you plan to retire. But do you know the rules of the road when it comes to Social Security?

Here’s an opportunity to attend a valuable educational seminar on this important topic, at no cost and no obligation:

- What are the rules for starting your Social Security benefits?

- How do spouses coordinate their benefits?

- Are there different routes to take that could potentially increase your benefits?

- How do you decide where Social Security fits within your retirement plans?

- When:

Thu, May 4, 2023 - Where:

BrightStar Credit Union Headquarters

5901 Del Lago Circle

Sunrise, FL 33313 - The seminar starts from 6:00 PM – 7:00 PM EST

The Return of Conservative Investing - Jan 26

The Return of Conservative Investing

Seminar Details

In this seminar, you’ll learn how conservative investments like certificates of deposit and annuities can help your financial plan.

Seminar Objectives:

- How can conservative investments help you face today’s economic risks?

- What are the differences between CDs and annuities?

- What are the different types of annuities?

- How can you decide which conservative investment is right for you?

- When:

Thu, January 26, 2023 - Where:

BrightStar Credit Union Headquarters

5901 Del Lago Circle

Sunrise, FL 33313 - The seminar starts from 6:00 PM – 7:00 PM EST

Social Security and Your Retirement - Oct 20

Social Security and Your Retirement

Seminar Details

Social Security will likely be an important part of the road ahead regardless of when you plan to retire. But do you know the rules of the road when it comes to Social Security?

Here’s an opportunity to attend a valuable educational seminar on this important topic, at no cost and no obligation:

- What are the rules for starting your Social Security benefits?

- How do spouses coordinate their benefits?

- Are there different routes to take that could potentially increase your benefits?

- How do you decide where Social Security fits within your retirement plans?

- When:

Thu, October 20, 2022 - Where:

BrightStar Credit Union Headquarters

5901 Del Lago Circle

Sunrise, FL 33313 - The seminar starts from 6:00 PM – 7:00 PM EST

Learn When and Where to Use Credit

Learn When and Where to Use Credit

Why should I use credit?

- When making transactions that put a hold on the card, such as renting a hotel room or car.

Using credit in this situation allows you to have a form of payment for the rental without the risk of receiving a nonsufficient funds fee.

- To make use of rewards offered by the institution, such as cash back or benefits on purchases such as gas.

Members with these types of rewards will benefit from these features, so it is in their best interest to use their credit card. BrightStar credit cards come with the added benefits of NortonLifeLockTM Identity Theft Protection, travel benefits, accident insurance, auto rental, and luggage insurance at no extra cost.

Why should I use debit?

- To avoid debt or to stay within a budget.

It is important to be aware of how much money is available to you in order to avoid receiving an overdraft fee from the institution and possibly even the vendor, but keeping a budget with a debit card is much easier and doesn’t allow for the impulse to spend.

- When purchasing from a small business.

It is likely that small businesses must pay to process transactions made with a credit card, often the reason as to why there is a minimum amount set for those purchasing with credit, so using a debit card will end up making transactions easier for both parties.

Spoof Calls Alert

Spoof Alert

Please beware of spoof calls asking for your Secure Access Code, Card Number or PIN Number over the phone. If you receive a call from anyone asking for this information, please call us at 954.486.2728. Your financial safety remains our priority.

Related Fraud Alerts

Spoof Calls Alert

July 15, 2022

Please beware of spoof calls asking for your Secure Access Code, Card Number or PIN Number.... Read more

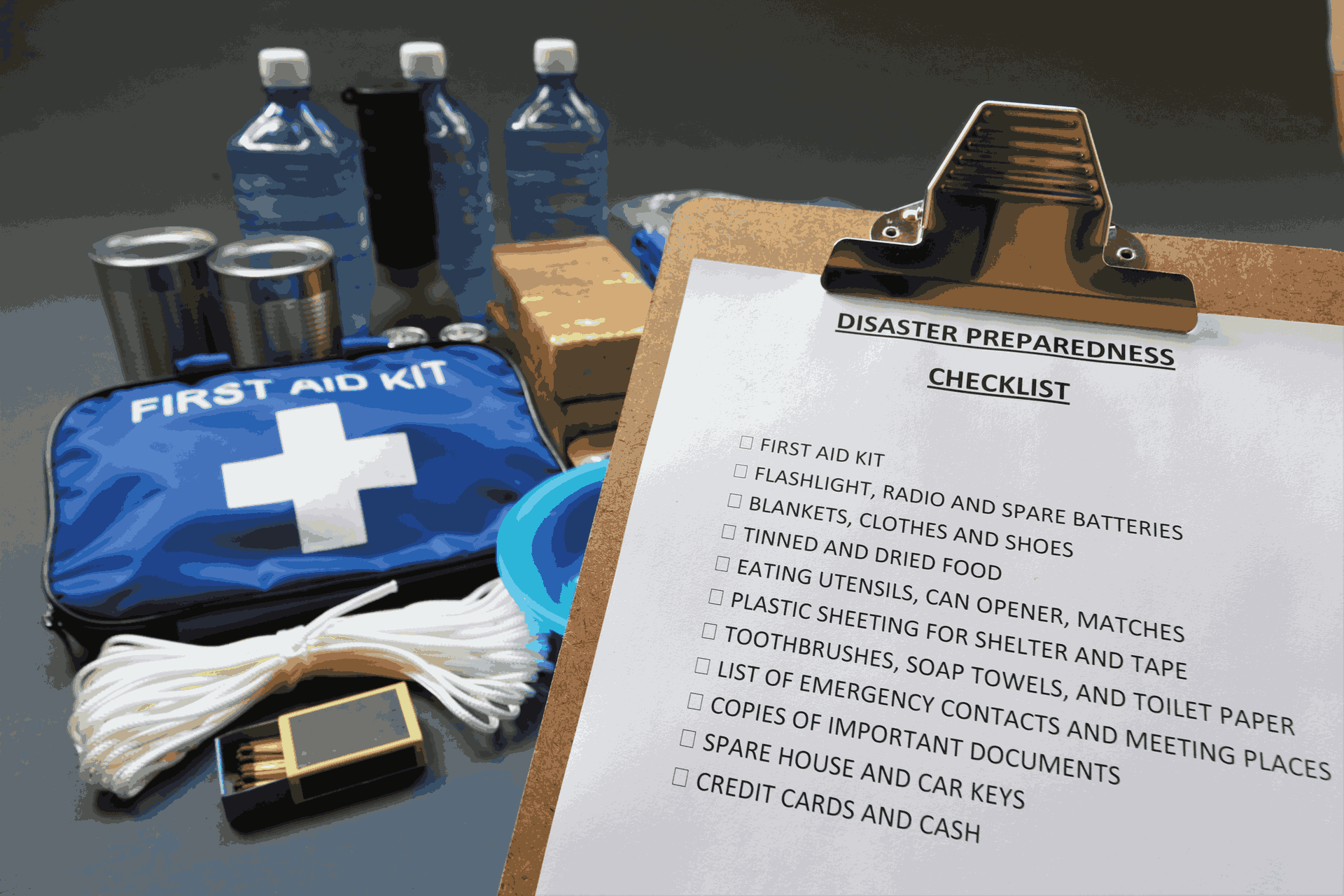

6 Ways to Prepare for the Hurricane Season

6 Ways to Prepare for the Hurricane Season

1. Hold a family meeting.

2. Make a plan to protect valuables.

3. Gather needed supplies.

4. Prepare any important documents.

5. Have a first-aid kit on hand.

- Sterile adhesive bandages (in assorted sizes)

- Sterile gauze pads

- Scissors

- Tweezers

- Antiseptic

- Thermometer

- Cleansing agent/ soap

- Latex gloves

It is also important to note that first-aid kits should include any prescription medication or emergency medication that someone in the home may need. Devices such as inhalers, for example, should be refilled in the case of an emergency in the home.

6. Understand how a hurricane may affect your home.

Students’ Guide to Personal Finances and Credit Unions

Students’ Guide to Personal Finances and Credit Unions

What are credit unions?

What can BSCU offer students?

Navigating Economic Uncertainty in 2022 - July 13

Navigating Economic Uncertainty in 2022

Economic uncertainty is scary but there are ways to alleviate this for you and your family. We've compiled steps and tips to navigate 2022.

Join us at our Corporate Headquarters to dive into ways you can curve the daunting economy. Our knowledgeable speaker is one of BrightStar's own, and she will be giving great tips on the following:

- How to handle rising interest rates, gas prices, and inflation on many common day goods.

- Advice for your family to follow that can help save hundreds a month.

- Interesting statistics on the current economic climate and what that means to YOU.

- And much more!

This will be an interactive event where you can ask questions and make comments. We will be providing food, beverages, and giveaways!

- When:

Wed, July 13, 2022 - Where:

BrightStar Credit Union Headquarters

5901 Del Lago Circle

Sunrise, FL 33313 - The seminar starts from 6:00 PM – 7:00 PM EST